Solutions for MGAs

Scale profitably in high-hazard markets with automated workflows and engineering-grade structural validation.

Streamlined Underwriting Operations

Automated workflows and data processing eliminate manual backlogs, enabling underwriters to handle 3x more submissions without adding headcount.

Lower expense ratios

Increase underwriting efficiency

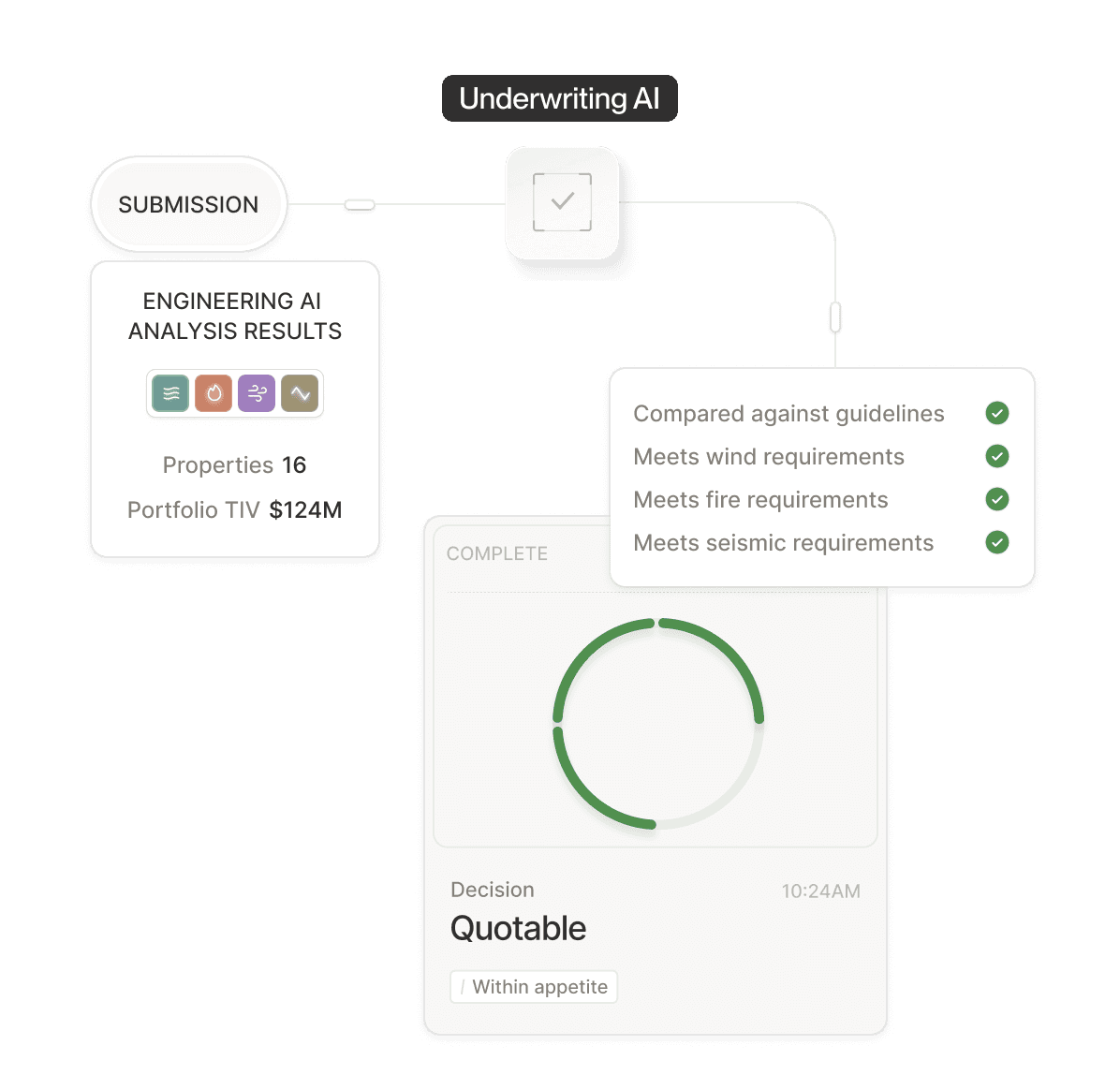

Profitable Growth in High-CAT Markets

Superior risk differentiation enables profitable writing in catastrophe-exposed markets where competitors retreat, while delivering fast service brokers demand.

Market share growth

Stronger broker relationships

Improved capital efficiency

NatCat underwriting demands more than generic AI

Perils Covered

Earthquake, wildfire, windstorm, flood.

Integration

API, CAT-model ready exports, seamless UI.

Geographies

Supports 99% of US, AK, HI.

AI Agents

AI built to work together or modular.

Occupancies

Supports most US occupancy types.

Configurable workflows built for property programs

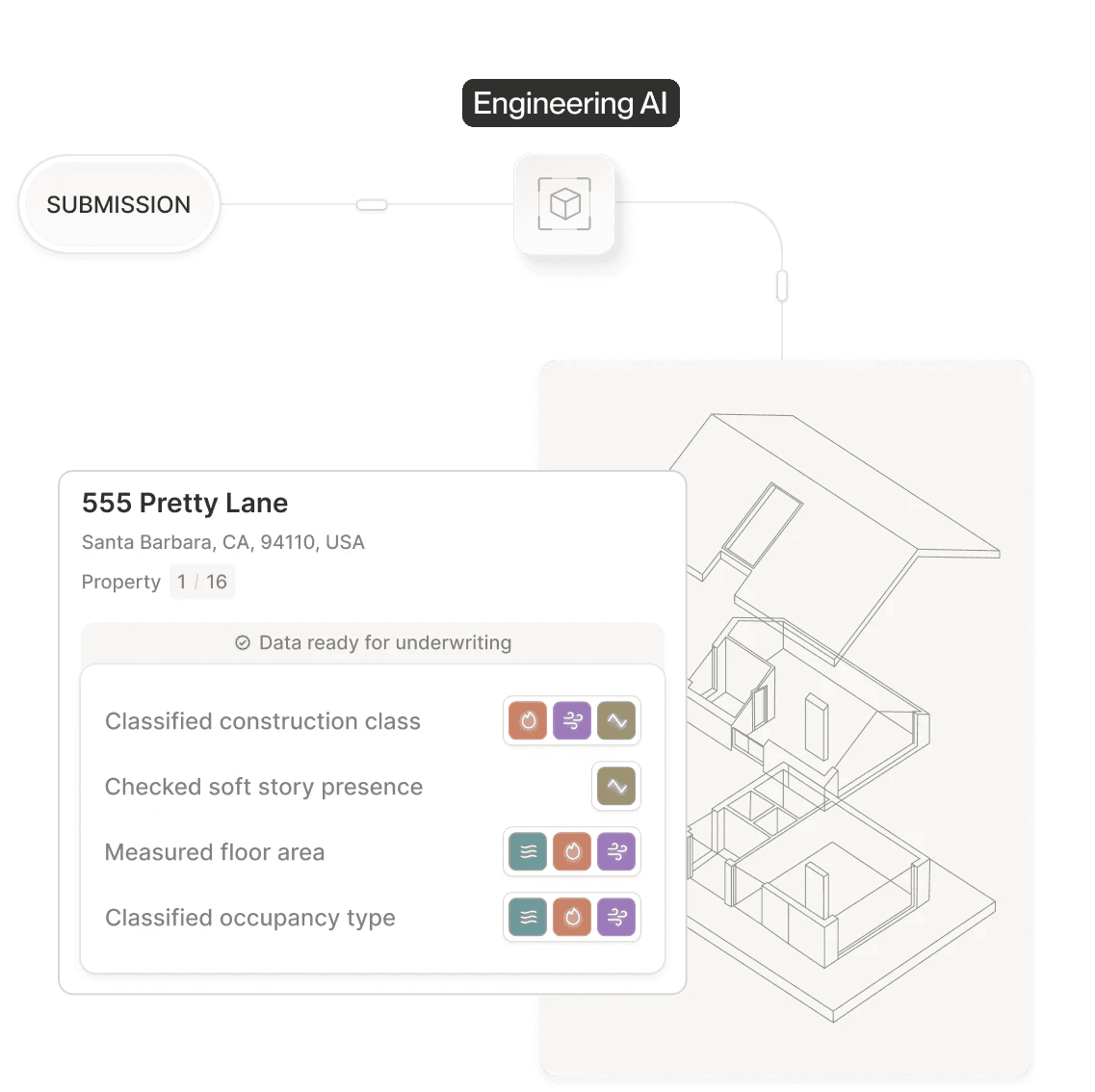

Automated intake and property data normalization

Configurable intake workflows process any submission format—ACORDs, SOVs, emails, PDFs—automatically normalizing COPE data and routing based on your triage logic. Your underwriters focus on underwriting, not data entry.

Bank-grade security, insurance-grade scale.

ResiQuant safeguards property and underwriting data with enterprise-grade security — built into every step of the workflow.