End-to-end AI for NatCat property underwriting

Automate submission processing, validate structural characteristics, and enforce underwriting guidelines—turning catastrophe complexity into confident, scalable decisions.

submission intake to decision in minutes, not hours or days.

Consistent underwriting

complex risk selection criteria applied on every case, without leakage.

Engineering-grade visibility

virtual inspections on every property before files are reviewed.

Stronger portfolio management

with more throughput and less manual work.

AI that understands property insurance & building science

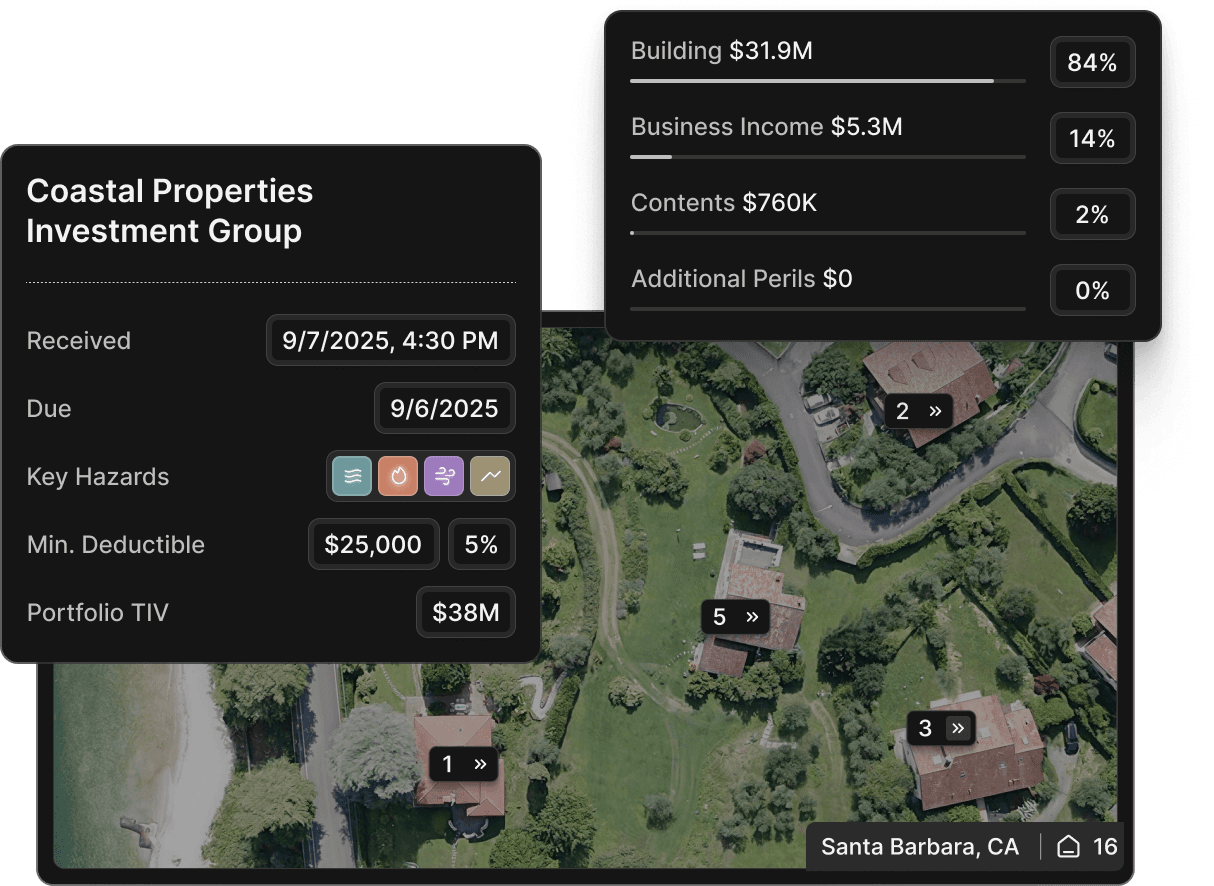

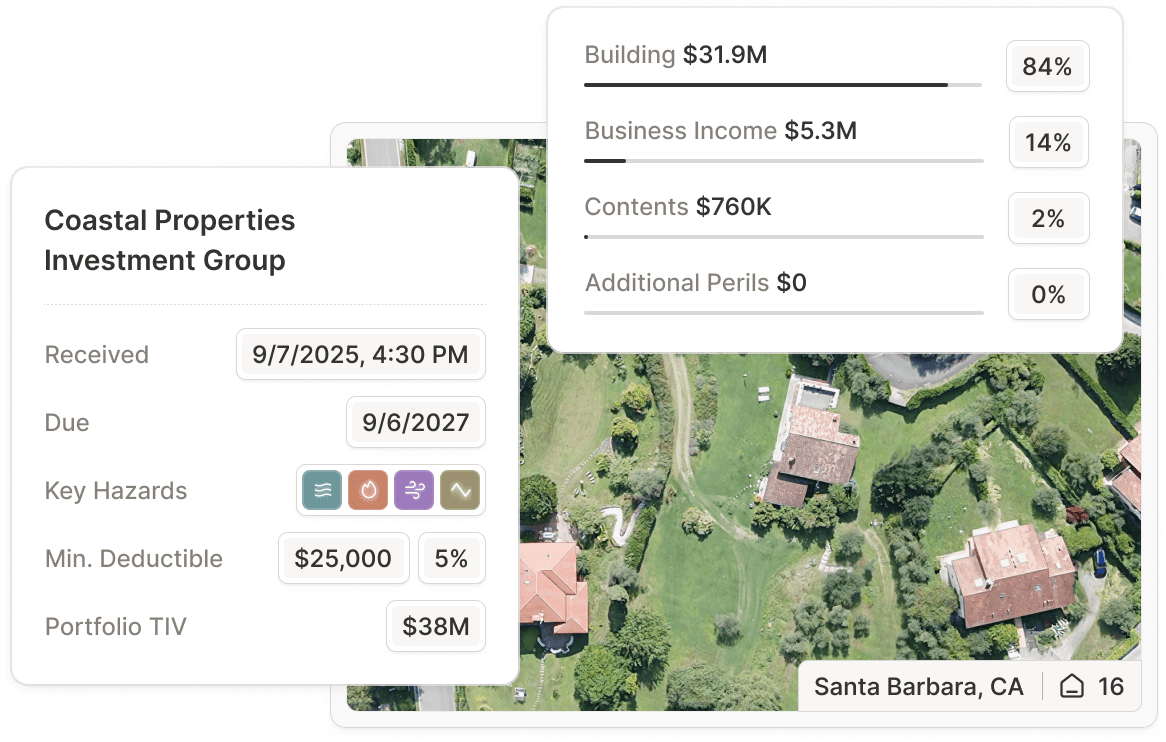

Submission AI

Transform inconsistent submissions into standardized, model-ready data. Submission AI eliminates manual rekeying and backlog by instantly converting any file format into validated records.

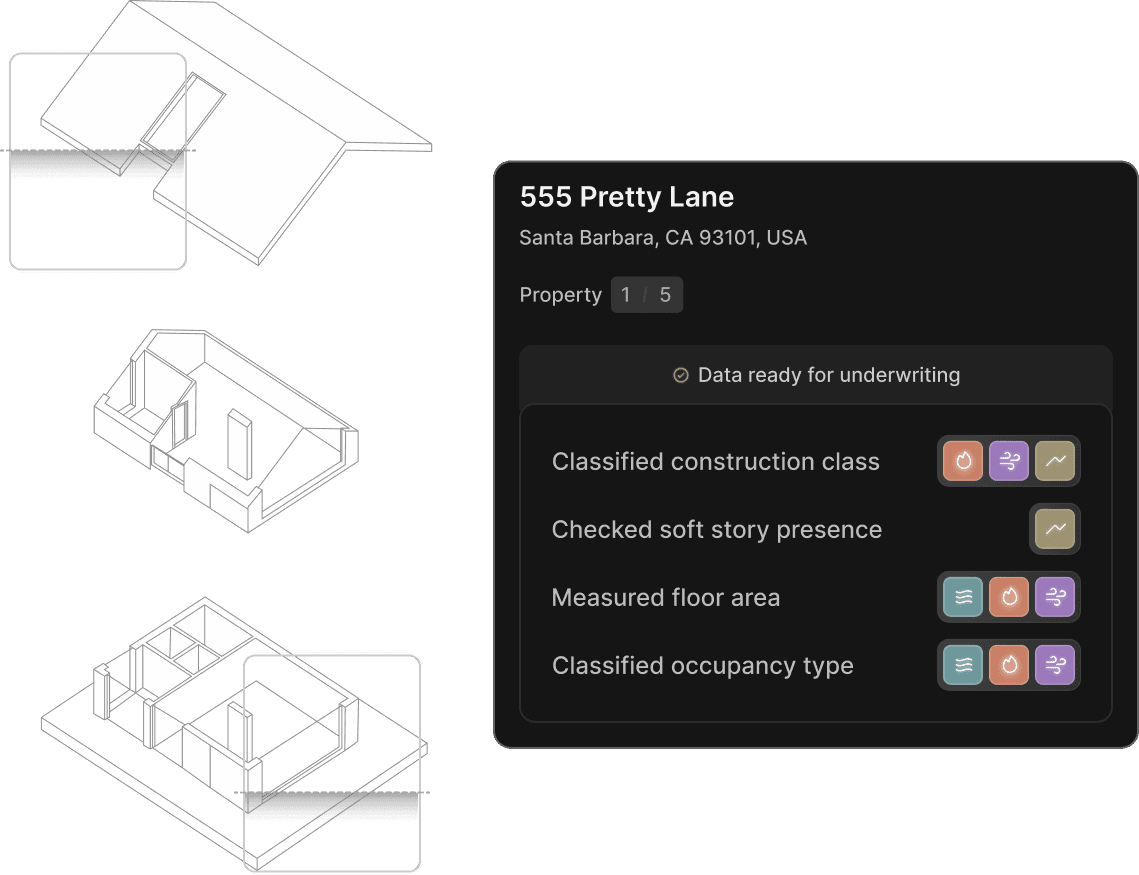

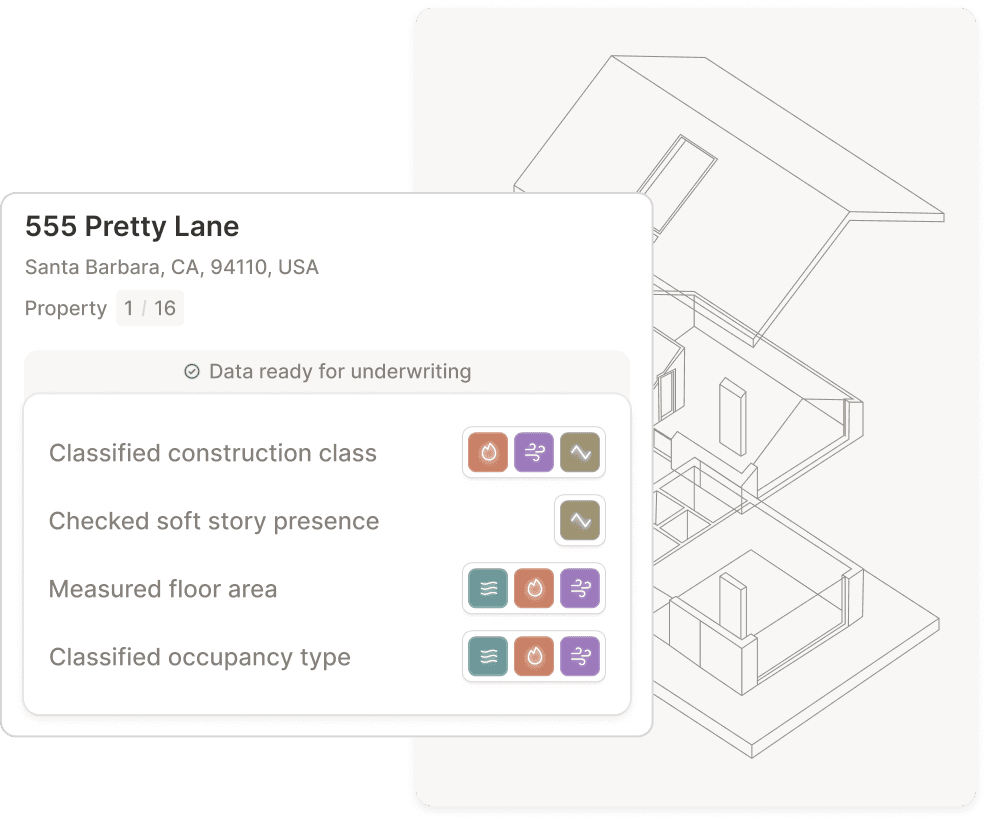

Engineering AI

Expose the true structural and hazard risks of every building. Engineering AI delivers engineering-grade visibility, surfacing vulnerabilities that traditional submissions and inspections miss.

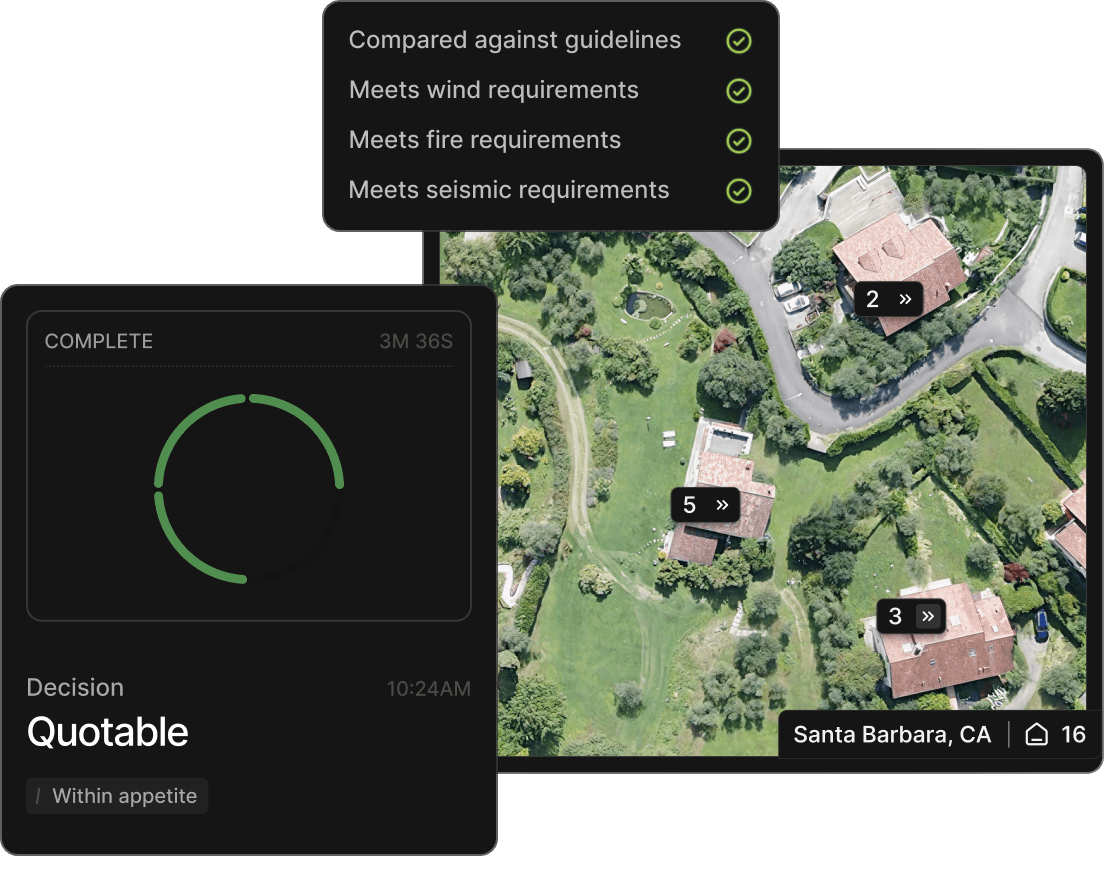

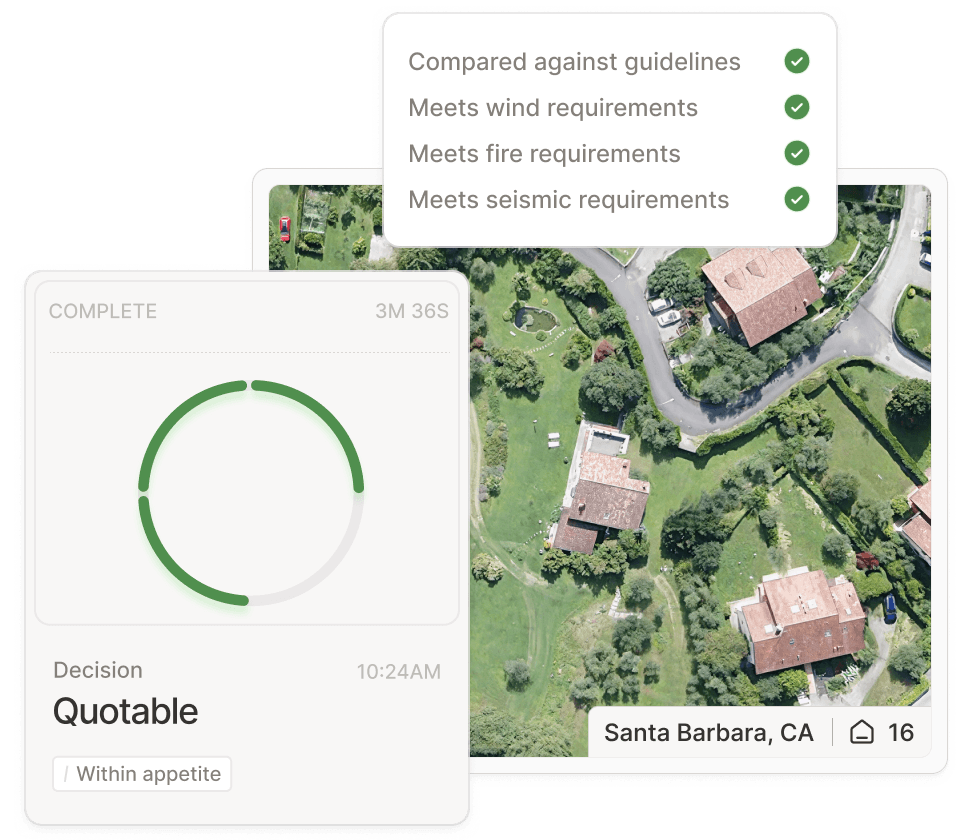

Underwriting AI

Apply underwriting rules instantly and consistently across every submission. Underwriting AI screens risks in real time so underwriters spend less time on unbindable files and more time on profitable opportunities.

Comprehensive coverage for complex property

ResiQuant supports underwriting across the toughest property markets.

Integration

API, CAT-model ready exports, seamless UI.

Geographies

Supports 99% of US, AK, HI.

Perils Covered

Earthquake, wildfire, windstorm, flood.

AI Agents

AI built to work together or modular.

Occupancies

Supports most US occupancy types.

Built to plug in anywhere. Built to scale everywhere.

ResiQuant doesn’t just connect agents — it connects the entire underwriting workflow. With API-first design and standardized data exchange, every output flows cleanly into portfolio management, reinsurance, and downstream systems.

API-first design: Every agent accessible via APIs.

Fast start: Secure email auto-forwarding, no heavy IT lift required.

Standardized, validated data:Clean, consistent, model-ready data across all systems. Ready for downstream decisions.

Bank-grade security, insurance-grade scale.

Enterprise-grade security built for catastrophe underwriting—SOC 2 Type II certified, AES-256 encryption, 24/7 monitoring.